Fifteen year morgage vs. a 30 year morgage

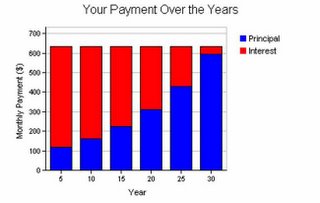

Well it only took me buying my 3rd home to convince myself that I needed to bite the bullet and get a 15 year morgage vs. a 30 year morgage. We have been here for 5 years now and I am really glad that we did it. I actually enjoy getting my statement each month because 2/3rd of the the payment is actually going to principle.A $100,000 loan on a 30 year term at 6.25% interest.

Monthly payment: $632

Principal portion of payment: Under $95 each month for the first year

Interest portion of payment: Under $536 each month for the first year

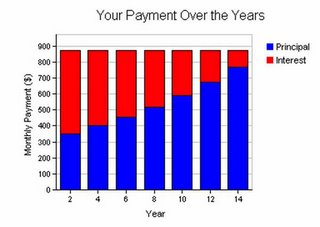

Ok now lets take the same loan on a 15 year term.

Monthly payment: $871

Principal portion of payment: Under $350 each month for the first year

Interest portion of payment: Under $521 each month for the first year

Of course the 15 year loan will cost you $239 more per month. However, your really should consider it savings because each month you will be contributing $350 to your principle. So after the first year you will have paid off $3500 on your house vs. $1200 on the 30 year loan. If you can't afford the 15 year loan either buy a less expensive house or put more money down. The chart below shows you how after just 8 years half of your payment will be going toward principle.

I found a great morgage calculator that allows you too compare 15 and 30 year morgages all on one chart. Click here to compare

Another excellent source for morgage rates check our Bankrate.com

Tags: Banking Real Estate Credit Credit Protection

Note: Morgage intentionally misspelled to assist in your search. Morgage is properly spelled mortgage.