Option ARM Home Mortgages Danger In The Fine Print

BusinessWeek Magazine

had a very scary article in the last issue about

Option Arm Mortgages also know as

Negative Amortization. I am always amazed when I hear radio spots advertising Smart Loans Mortgages, or

Interest only loans. It is hard for me to believe that the mortgage industry keeps pitching they types of loans to the public only to create and upside-down situation in the future. How would you like to be living in Michigan right now where the unemployment rate is getting higher, housing sales are very slow, you loose your job and you find out that the balance on your mortgage is actually higher than the value of your house. That's my definition of being upside-down on your loan. It happens all the time in the car loan business. But on your house that can be a real nightmare.

Businessweek said "the option adjustable rate mortgage (ARM) might be the riskiest and most complicated home loan product ever created. With its temptingly low minimum payments, the option ARM brought a whole new group of buyers into the housing market, extending the boom longer than it could have otherwise lasted, especially in the hottest markets. Suddenly, almost anyone could afford a home -- or so they thought. The option ARM's low payments are only temporary. And the less a borrower chooses to pay now, the more is tacked onto the balance.

Home buyers need to beware the Option ARM's low installments are not fixed for the first five years like a tradition ARM or Adjustable Rate Mortgage. Since the housing boom has come to a halt and because home prices have leveled off, borrowers can't count on rising equity to bail them out. Additionally the Option ARM has significant prepayment penalties which make it costly for you to refinance and get out of the loan. Basically, it is a trap.

One example given by BusinessWeek was "Gordon Burger a 42-year-old police officer from a suburb of Sacramento, Calif., is stuck in a new mortgage that's making him poorer by the month. Burger, a solid earner with clean credit, has bought and sold several houses in the past. In February he got a flyer from a broker advertising an interest rate of 2.2%. It was an unbeatable opportunity, he thought. If he refinanced the mortgage on his $500,000 home into an option ARM, he could save $14,000 in interest payments over three years. Burger quickly pulled the trigger, switching out of his 5.1% fixed-rate loan. "The payment schedule looked like what we talked about, so I just started signing away," says Burger. He didn't read the fine print. After two months Burger noticed that the minimum payment of $1,697 was actually adding $1,000 to his balance every month. "I'm not making any ground on this house; it's a loss every month," he says. He says he was told by his lender, Minneapolis-based Homecoming Financial, a unit of Residential Capital, the nation's fifth-largest mortgage shop, that he'd have to pay more than $10,000 in prepayment penalties to refinance out of the loan. If he's unhappy, he should take it up with his broker, the bank said. "They know they're selling crap, and they're doing it in a way that's very deceiving," he says. "Unfortunately, I got sucked into it." In a written statement, Residential said it couldn't comment on Burger's loan but that "each mortgage is designed to meet the specific financial needs of a consumer."

According to the ariticle 80% of all option ARM borrowers make only the minimum payment each month. As a result of this the rest of the money gets added to the balance of the mortgage, which is called negative amortization. Unfortunately the situation gets even worse because as the balance grows after a certain point the mortgage automatically resets at a new higher payments.

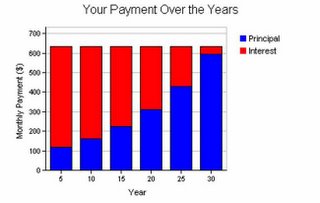

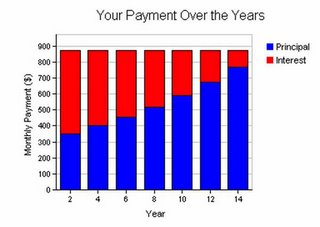

In conclusion, if something seems to good to be true it probably is. Make sure before you sign up for a non-traditional mortgage of any type understand what you are getting into. For free advice take the non-traditional mortgage paper work, before you sign, to a bank and take to the loan officer. Tell them that you are considering this type of loan and you would like there opinion on the loan vs. a traditional loan that there bank could offer you. In my opinion your best bet is to stick with a traditional 30 year or 15 year fixed mortgage and pay the thing off as fast as you can.

Related reading: Check out the following books if you are interested in learning more about mortgages, The 106 Mortgage Secrets All Homebuyers Must Learn--But Lenders Don't Tell  , and Mortgages for Dummies

, and Mortgages for Dummies .

.

Final thought do me a favor. If you enjoyed this post or any of my other posts why not subscribe to my Strategies for Life Blog? Again it is free, free is good right? Just click here.

Tags: investing, retirement, get rich, mortgages

Related links:

Thanks for visiting please check out my other blogs and websites:

If you enjoyed this post please Subscribe to Strategies for Life.

An Hour A Day. It is a great book to help you understand how to build traffic to your site.