What about the tax savings? A lot of people might tell you that the interest on your house is your biggest tax deduction. They say that you should borrow as much as possible for as long as possible if rates are cheap, so you can get the tax deduction. I my opinion, I don't consider paying interest on a loan a good tax deduction. Why would you want to spend a $1000s to get $250 back. Why not not payoff your house and not have to pay the $1000s in interest and then you would be $750 ahead. You could take the entire house payment and buy a CD, buy an ETF, save money in your 401K, start a 529 program for your kids college education, or even purchase an investment property. Additionally, there is something of a secure feeling to me about owning your own home and paying off your debts.

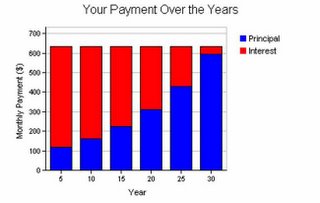

A $100,000 loan on a 30 year term at 6.25% interest.

Monthly payment: $632

Principal portion of payment: Under $95 each month for the first year

Interest portion of payment: Under $536 each month for the first year

Ok now lets take the same loan on a 15 year term.

Monthly payment: $871

Principal portion of payment: Under $350 each month for the first year

Interest portion of payment: Under $521 each month for the first year

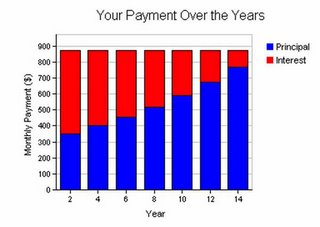

Of course the 15 year loan will cost you $239 more per month. However, as I said above, your really should consider it savings because each month you will be contributing $350 to your principle. So after the first year you will have paid off $3500 on your house vs. $1200 on the 30 year loan. If you can't afford the 15 year loan either buy a less expensive house or put more money down. The chart below shows you how after just 8 years half of your payment will be going toward principle amazing.

Not sure how all this works or how to calculte this? I found a great mortgage calculator that allows you too compare 15 and 30 year mortgages all on one chart. Click here to compare. Additionally, if you want to be able to calculate your payments on the go you should consider picking up a financial or business calculator

How to find current interest rates: I you are trying to find the latest mortgage rates in your area I highly recommedn you check out Bankrate.com.

Related reading or listening: If you are like me you might be more of a auditory listener, that is you learn more by listening. I purchased the audio book Turn Your Debt Into Wealth

Tags: Banking Real Estate Credit Credit Protection

No comments:

Post a Comment