Well it only took me buying my 3rd home to convince myself that I needed to bite the bullet and get a

15 year mortgage vs. a 30 year mortgage. We have been here for 5 years now and I am really glad that we did it. I actually enjoy getting my statement each month because 2/3rds of the the payment is actually going to principle. Think about it, a $1500 mortgage payment and $1000 of it is going to principle. It is more like a forced savings program.

What about the tax savings? A lot of people might tell you that the interest on your house is your biggest tax deduction. They say that you should borrow as much as possible for as long as possible if rates are cheap, so you can get the tax deduction. I my opinion, I don't consider paying interest on a loan a good tax deduction. Why would you want to spend a $1000s to get $250 back. Why not not payoff your house and not have to pay the $1000s in interest and then you would be $750 ahead. You could take the entire house payment and

buy a CD,

buy an ETF,

save money in your 401K,

start a 529 program for your kids college education, or even purchase an investment property. Additionally, there is something of a secure feeling to me about owning your own home and

paying off your debts.

One of the most important lessons that I learned later in my house buying history is the power of the

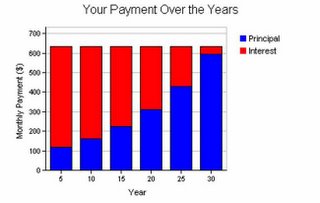

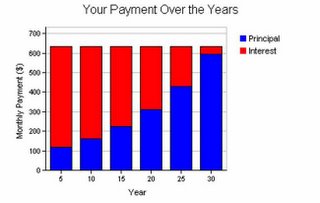

15 year mortgage. Whether it is your first house or last house try to buy the house that you can afford with a 15 year mortgage. You will be so much happier after 5 or 10 years and you decide to sell and upgrade to a larger house. Don't be worried about the fact that your house isn't as big as your friends house, think about it you won't be house poor and they will be. By using a

15 year mortgage your principle on the loan will be so much greater. Here a few examples.

A $100,000 loan on a 30 year term at 6.25% interest.

Monthly payment: $632

Principal portion of payment: Under $95 each month for the first year

Interest portion of payment: Under $536 each month for the first year

Ok now lets take the same loan on a 15 year term.

Monthly payment: $871

Principal portion of payment: Under $350 each month for the first year

Interest portion of payment: Under $521 each month for the first year

Of course the 15 year loan will cost you $239 more per month. However, as I said above, your really should consider it savings because each month you will be contributing $350 to your principle. So after the first year you will have paid off $3500 on your house vs. $1200 on the 30 year loan. If you can't afford the 15 year loan either buy a less expensive house or put more money down. The chart below shows you how after just 8 years half of your payment will be going toward principle amazing.

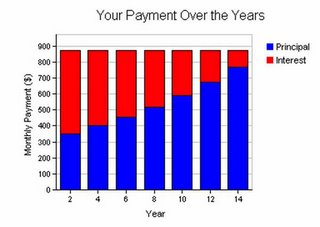

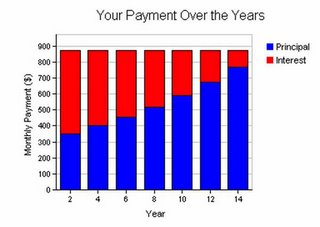

Not sure how all this works or how to calculte this? I found a great

mortgage calculator that allows you too compare

15 and 30 year mortgages all on one chart.

Click here to compare. Additionally, if you want to be able to

calculate your payments on the go you should consider picking up a

financial or business calculator

. I love it when I go into buy a car or get a new loan and I already know what my payment will be based on the amout that I put down on the car.

How to find current interest rates: I you are trying to find the latest mortgage rates in your area I highly recommedn you check out

Bankrate.com.

Related reading or listening: If you are like me you might be more of a auditory listener, that is you learn more by listening. I purchased the audio book

Turn Your Debt Into Wealth

by John M. Cummuta. If you are more of a reader checkout a book from the Rich Dad series called

The ABC's of Getting Out of Debt

.

Tags: Banking Real Estate Credit Credit Protection